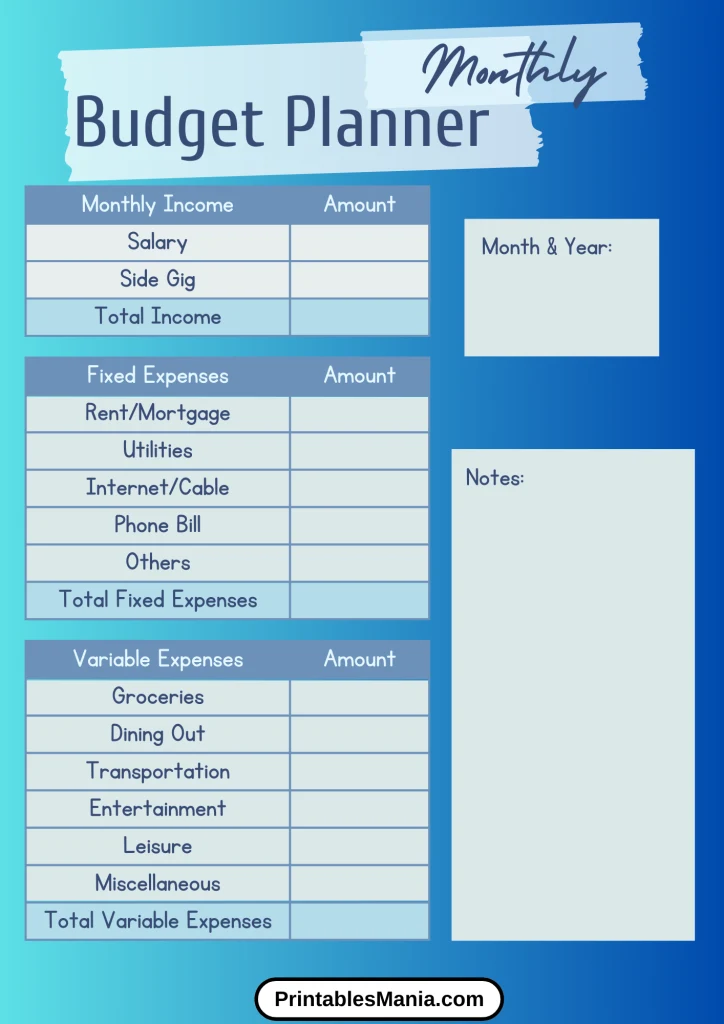

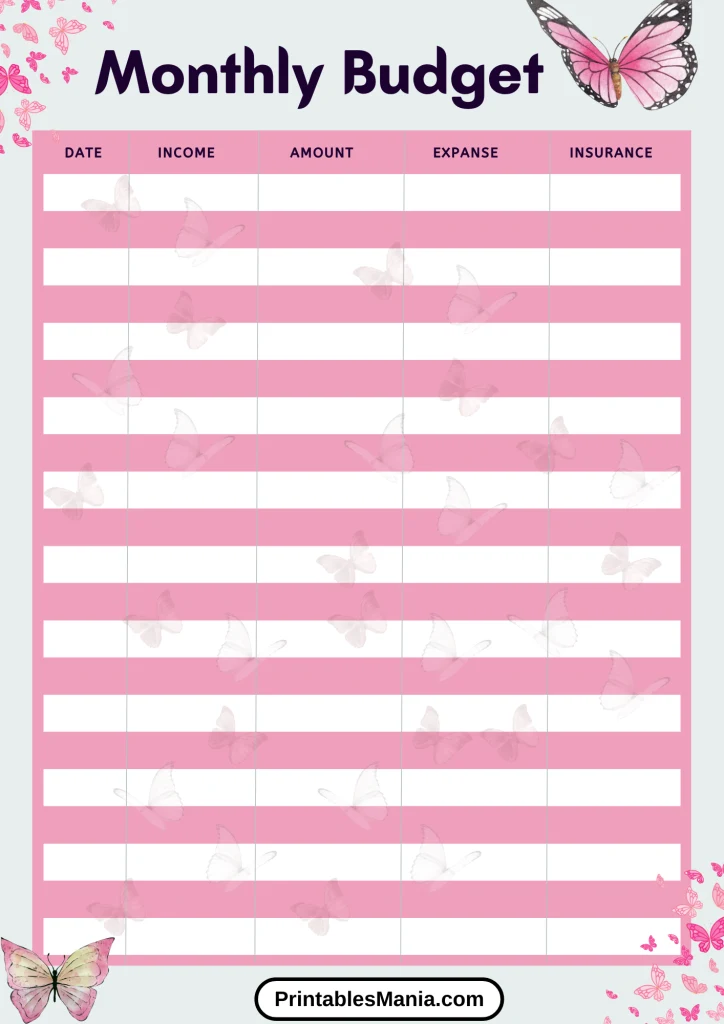

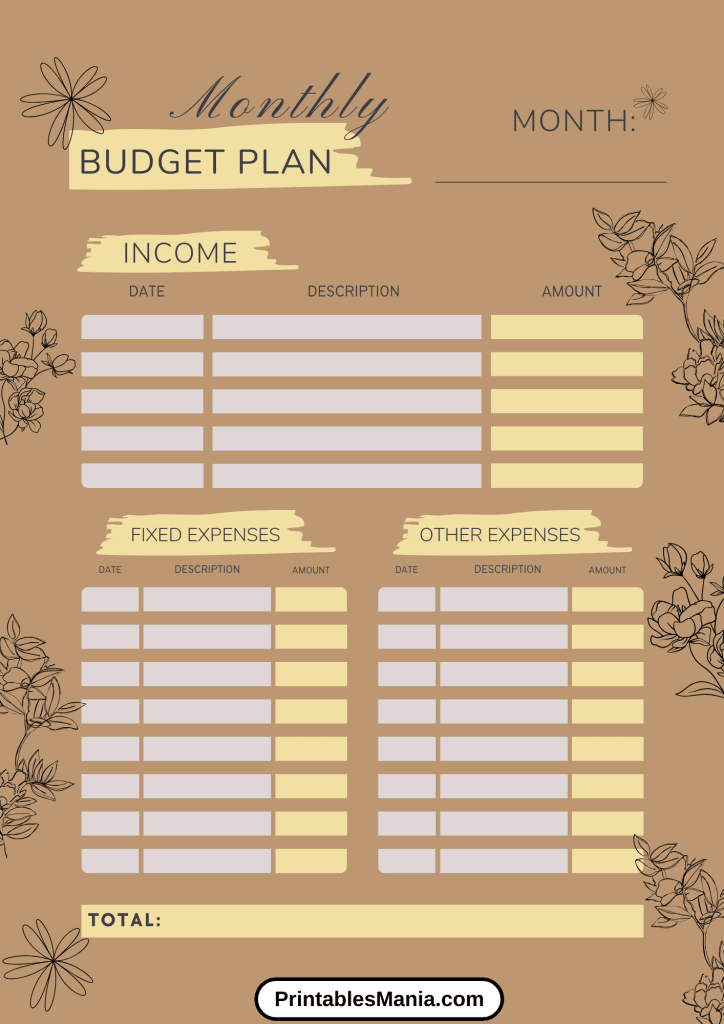

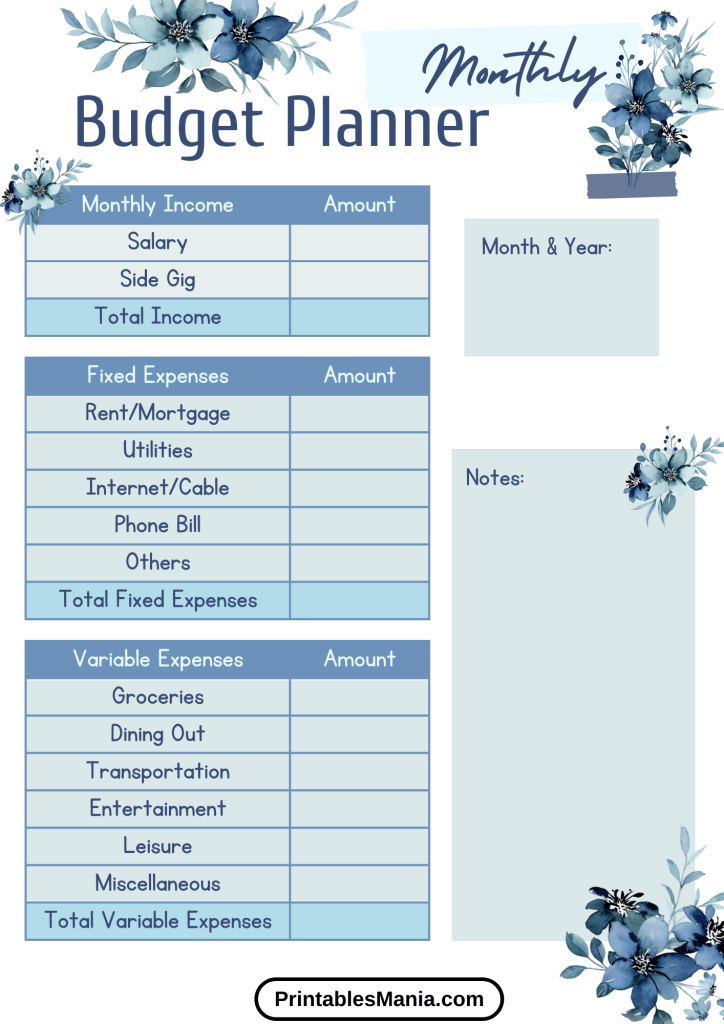

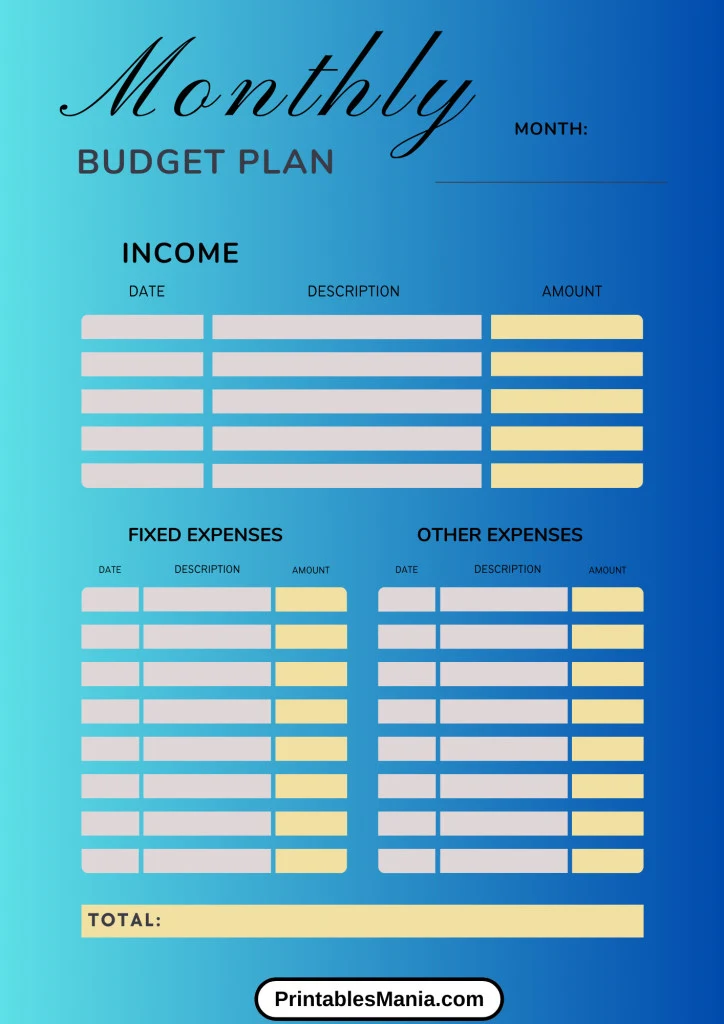

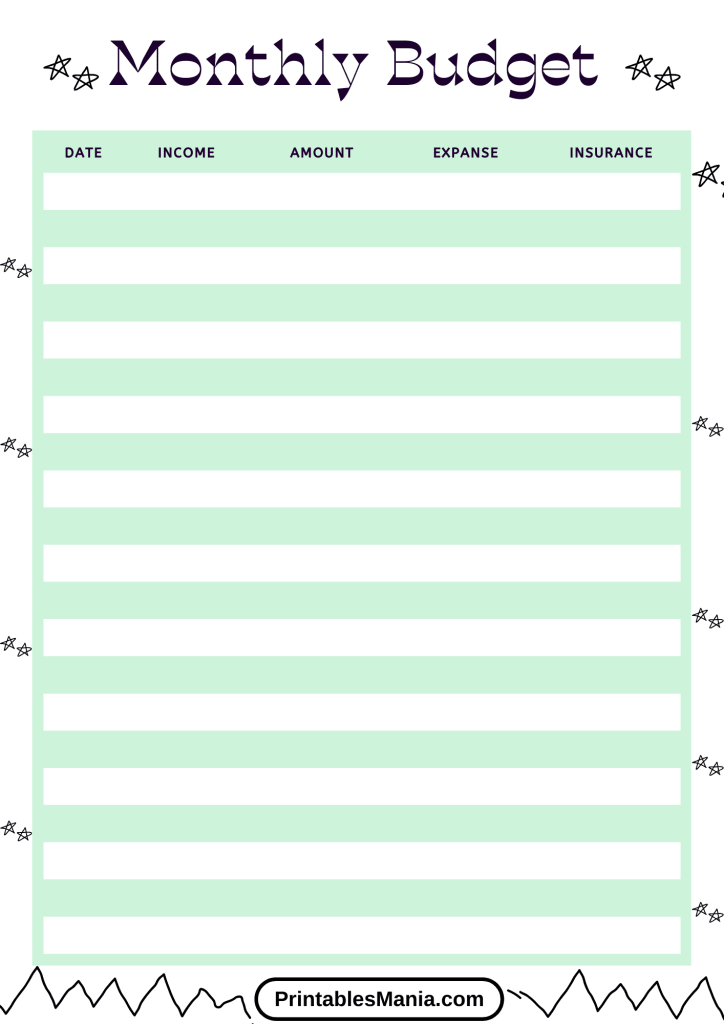

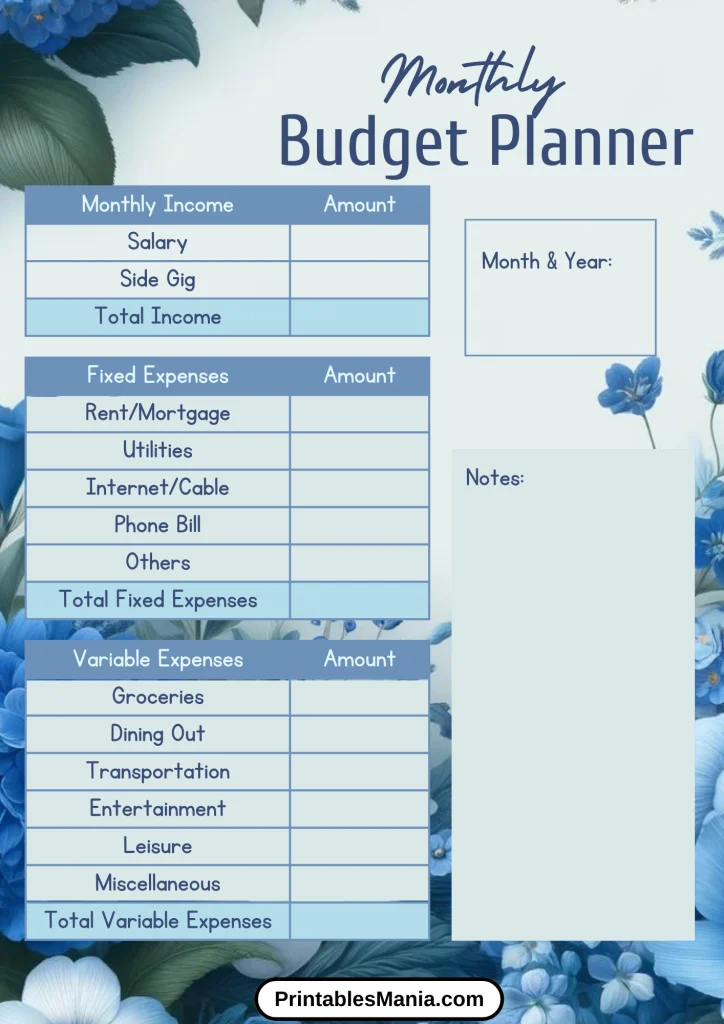

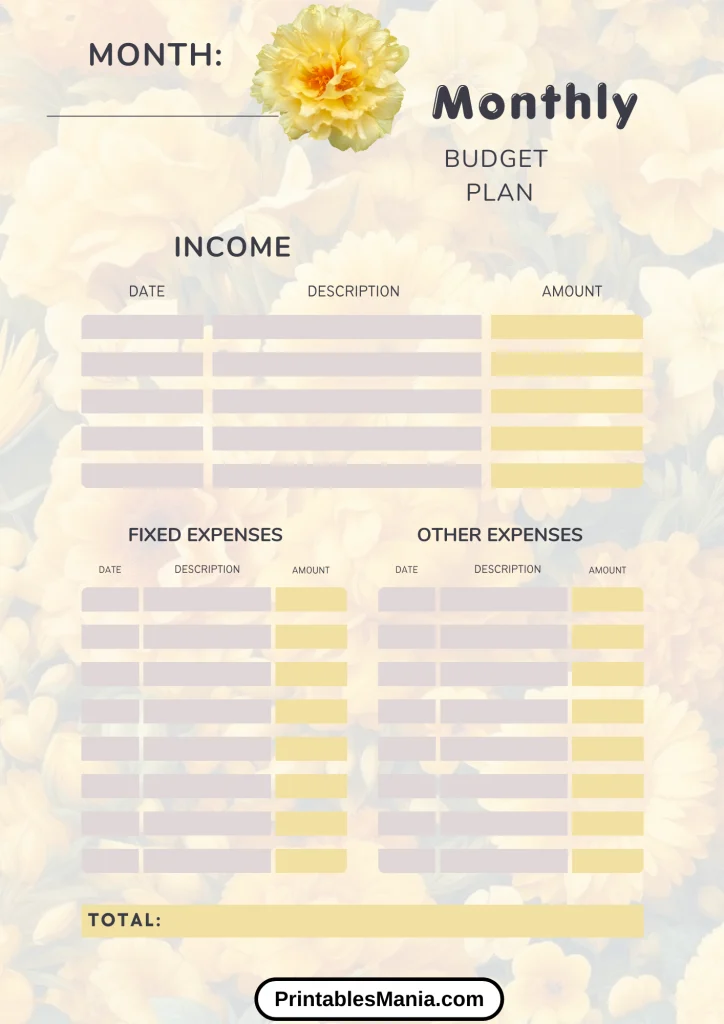

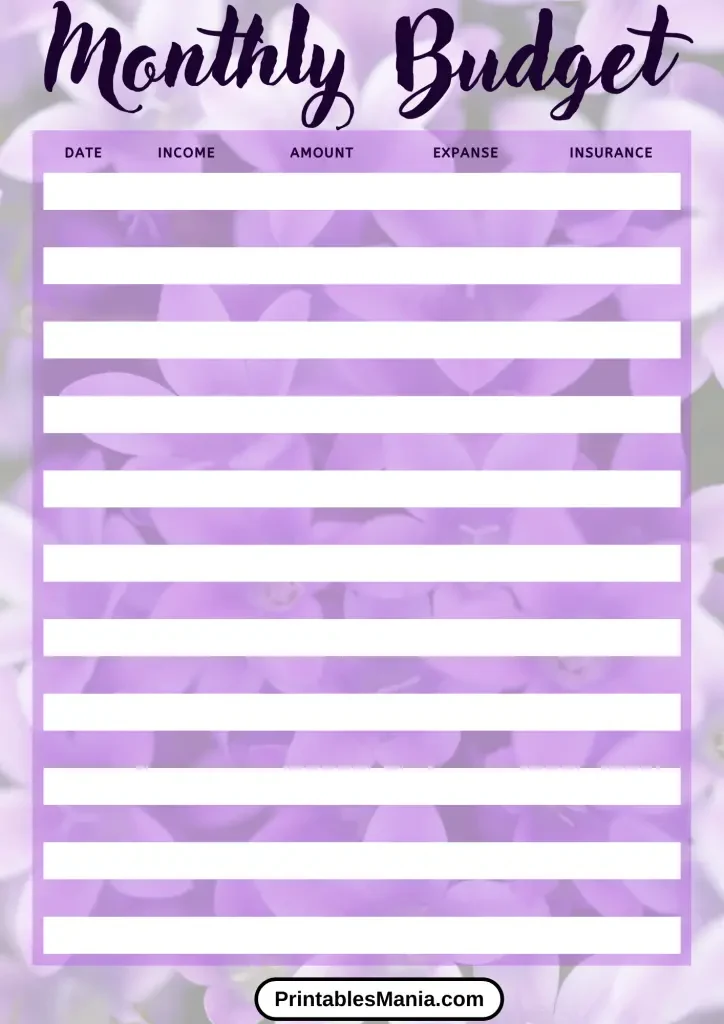

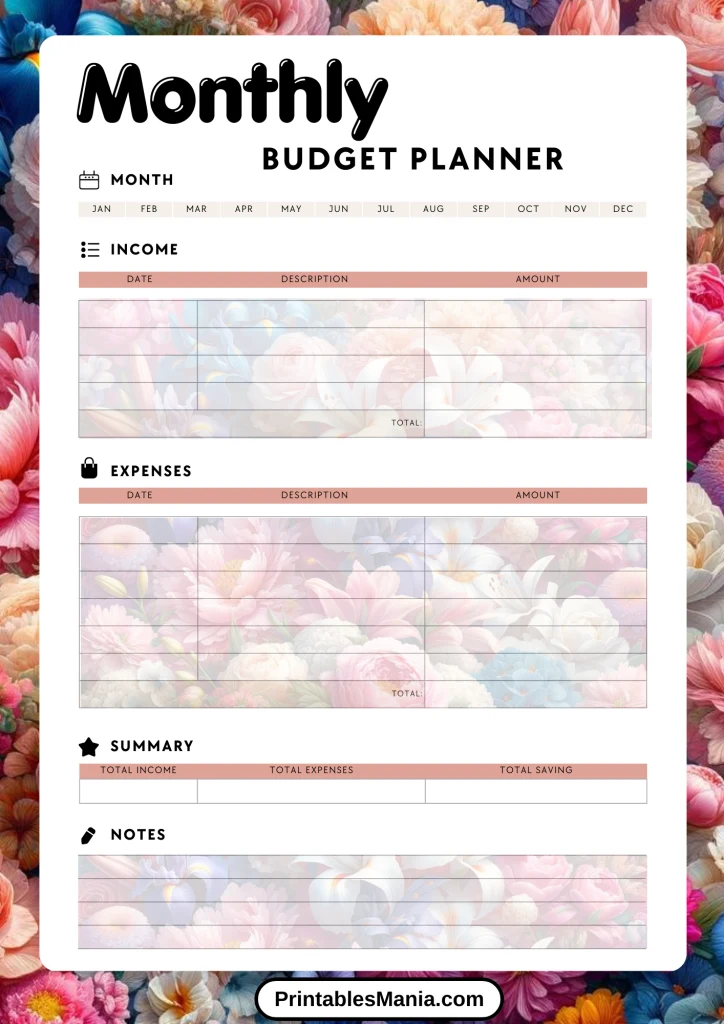

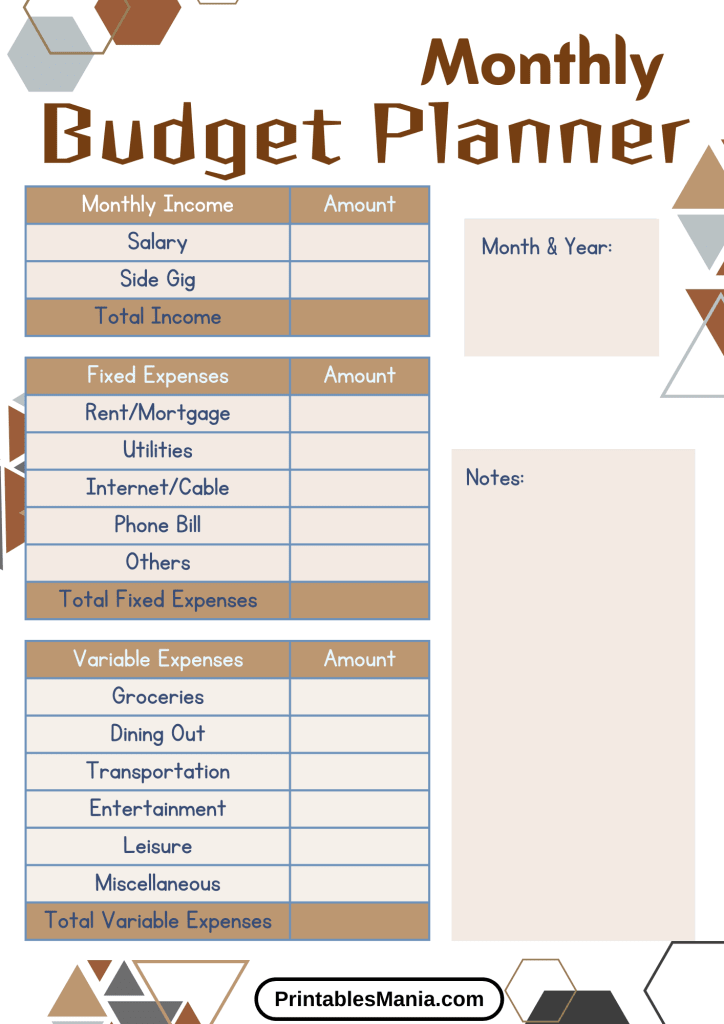

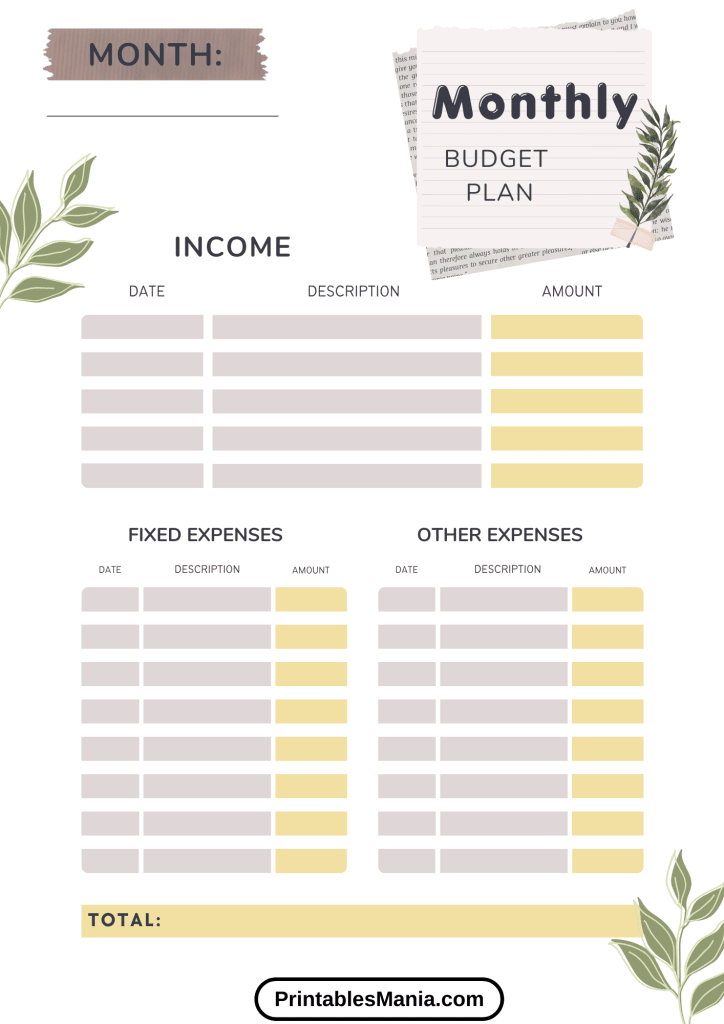

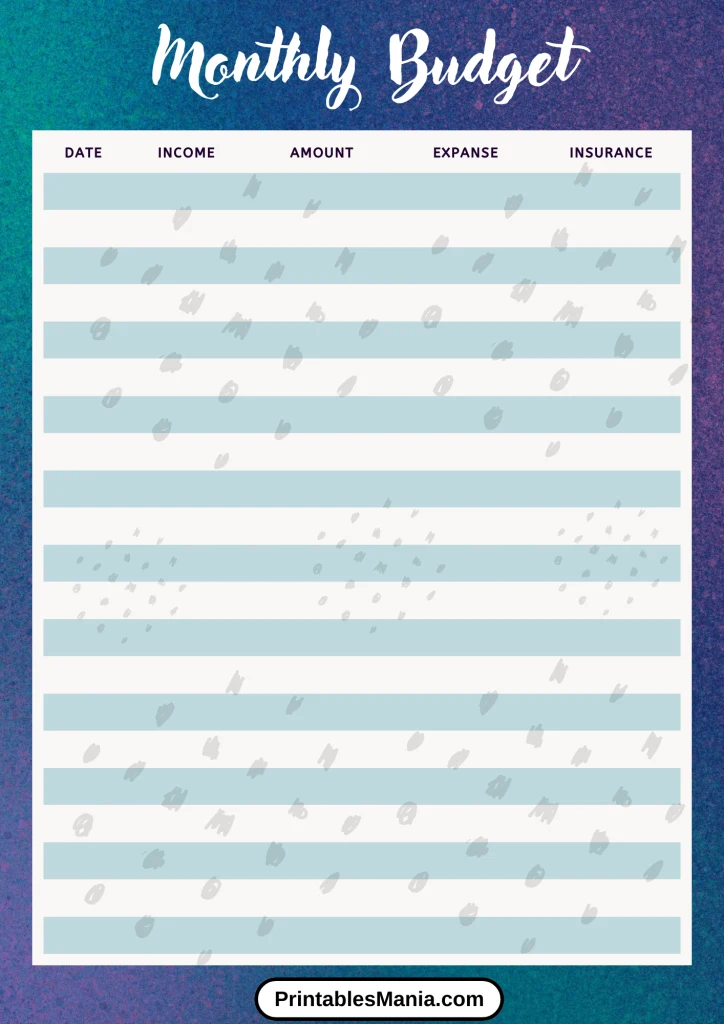

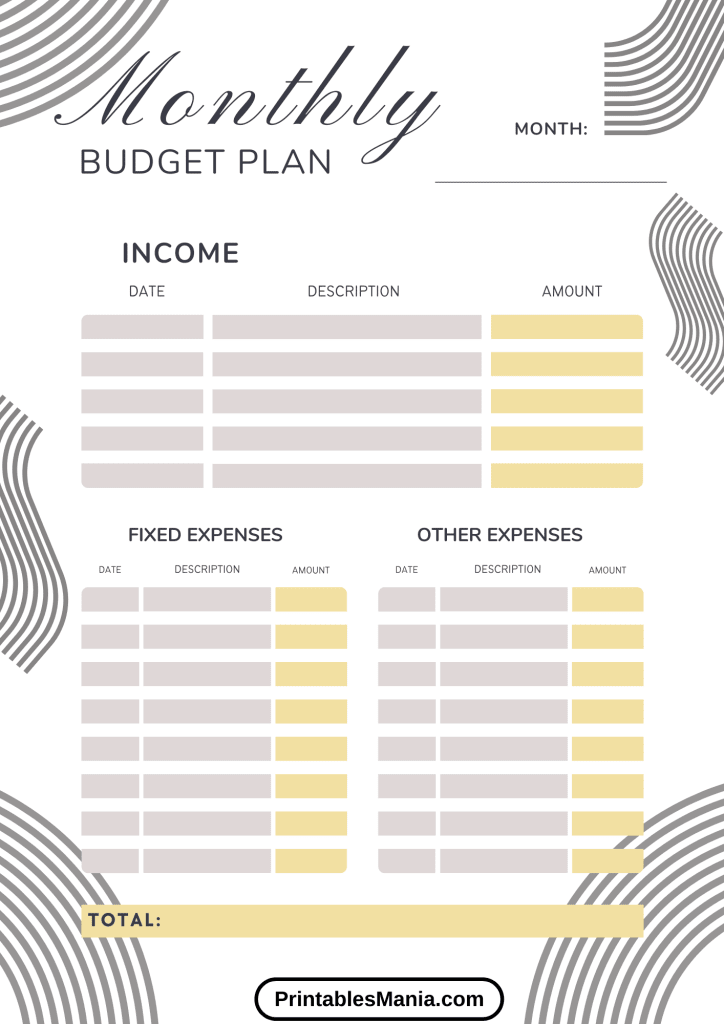

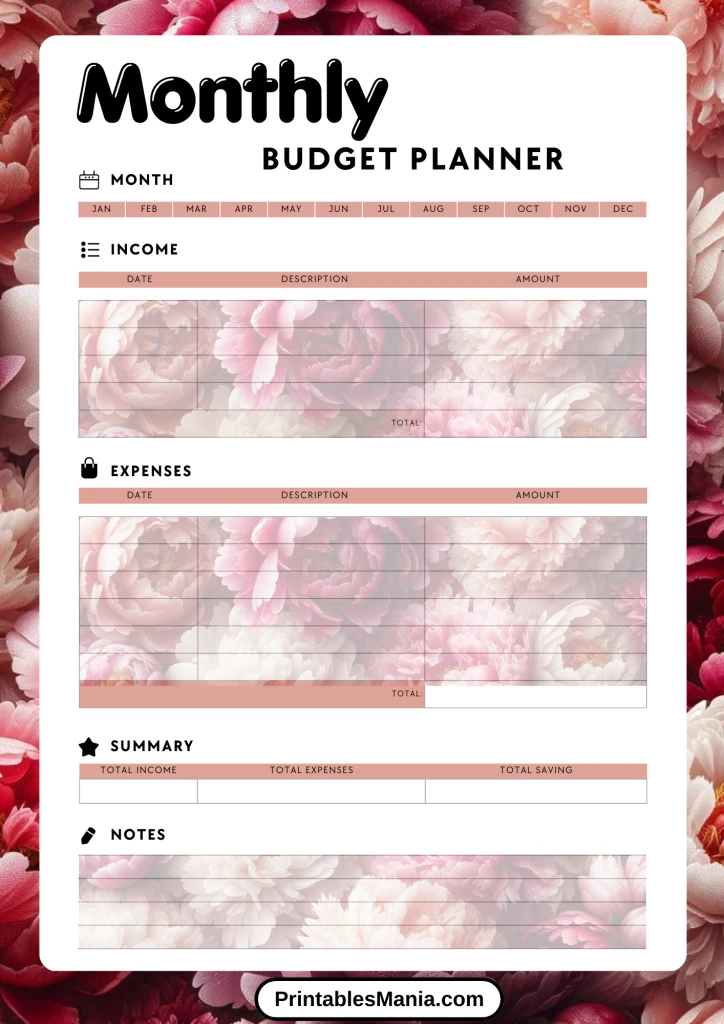

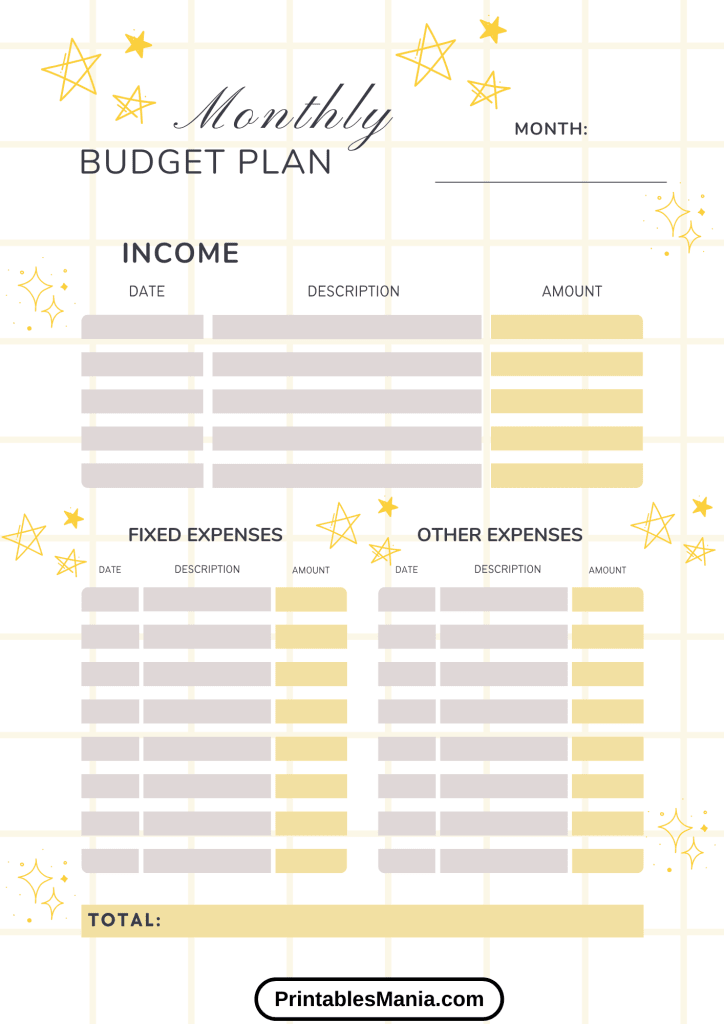

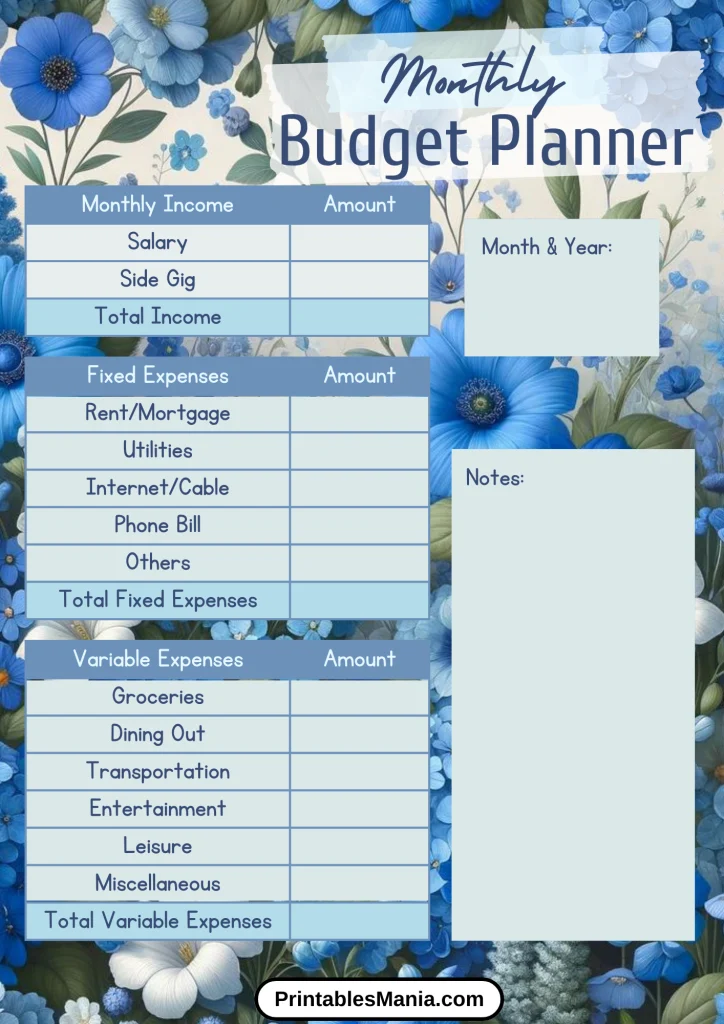

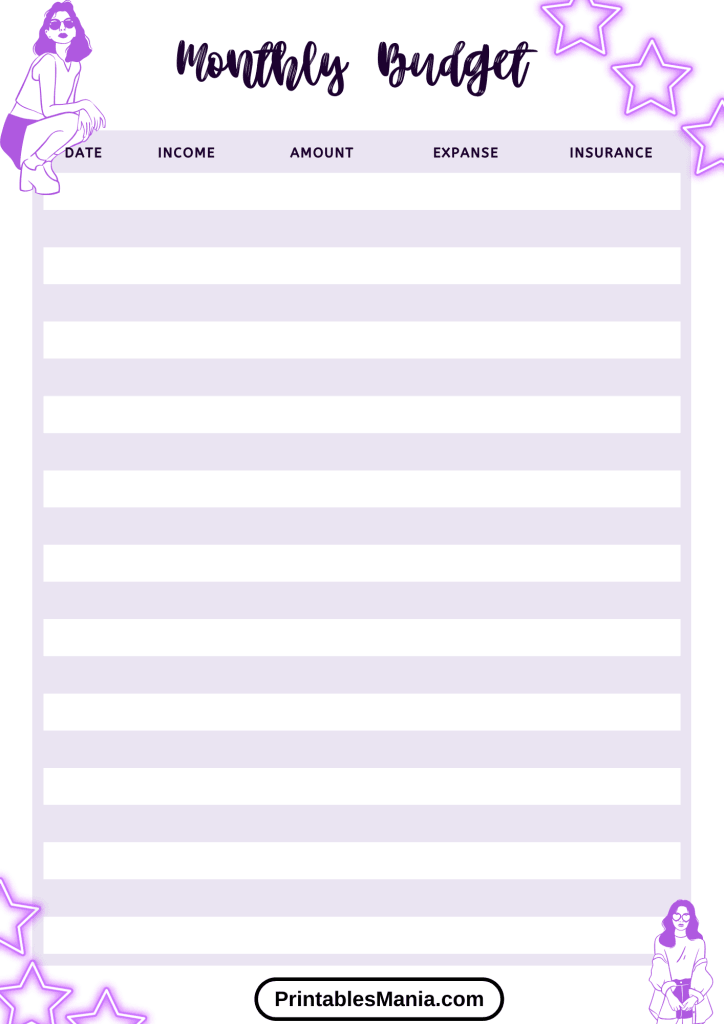

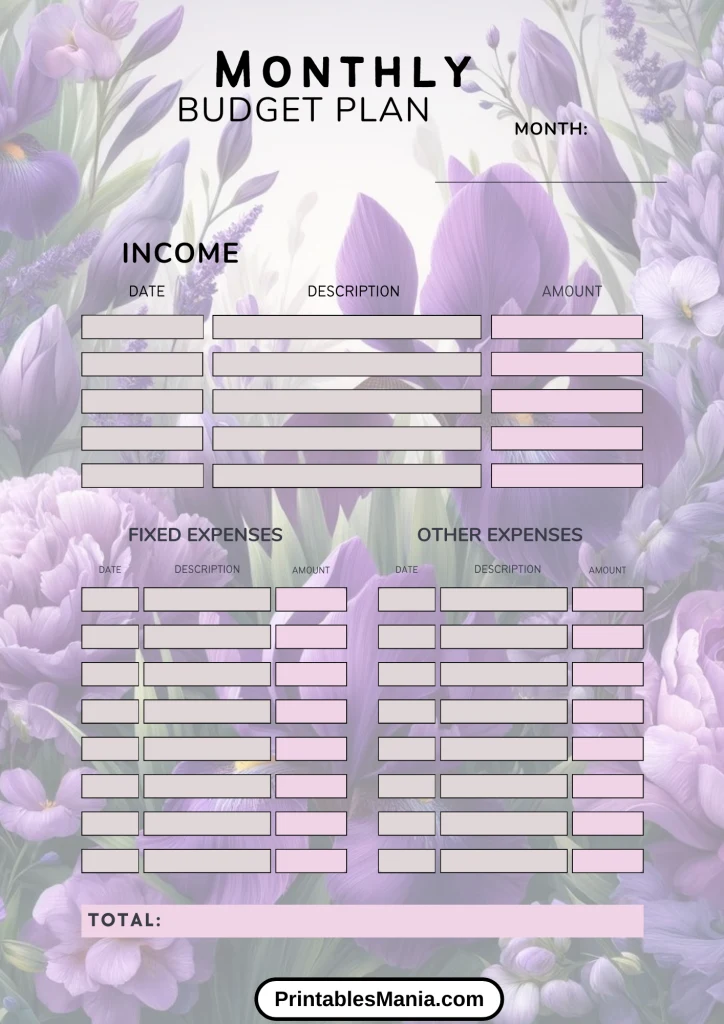

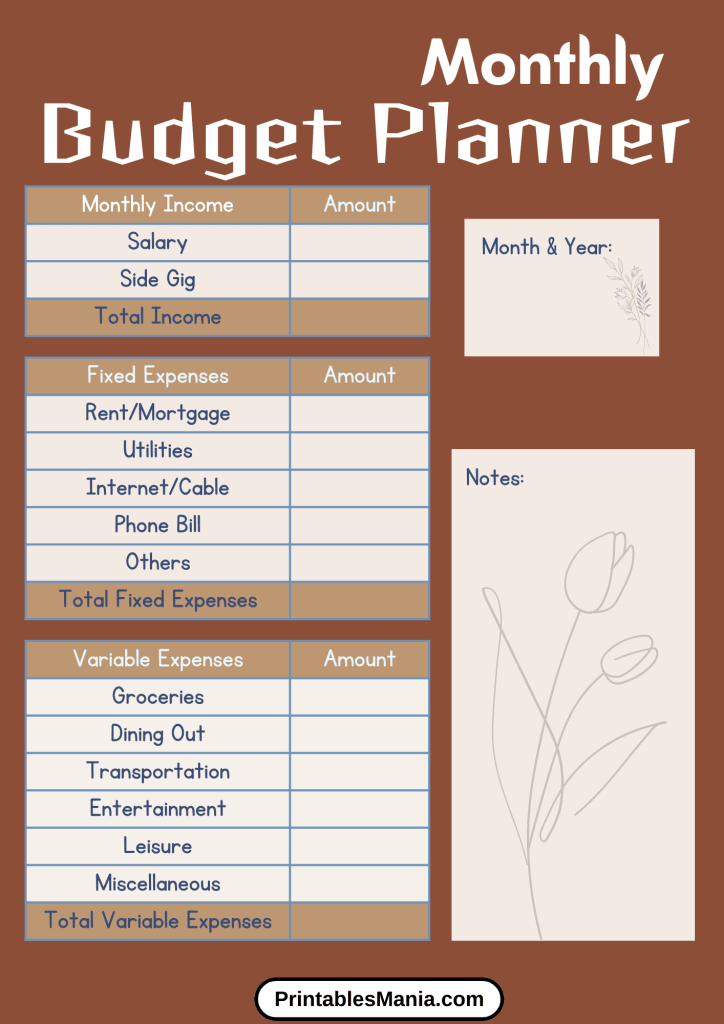

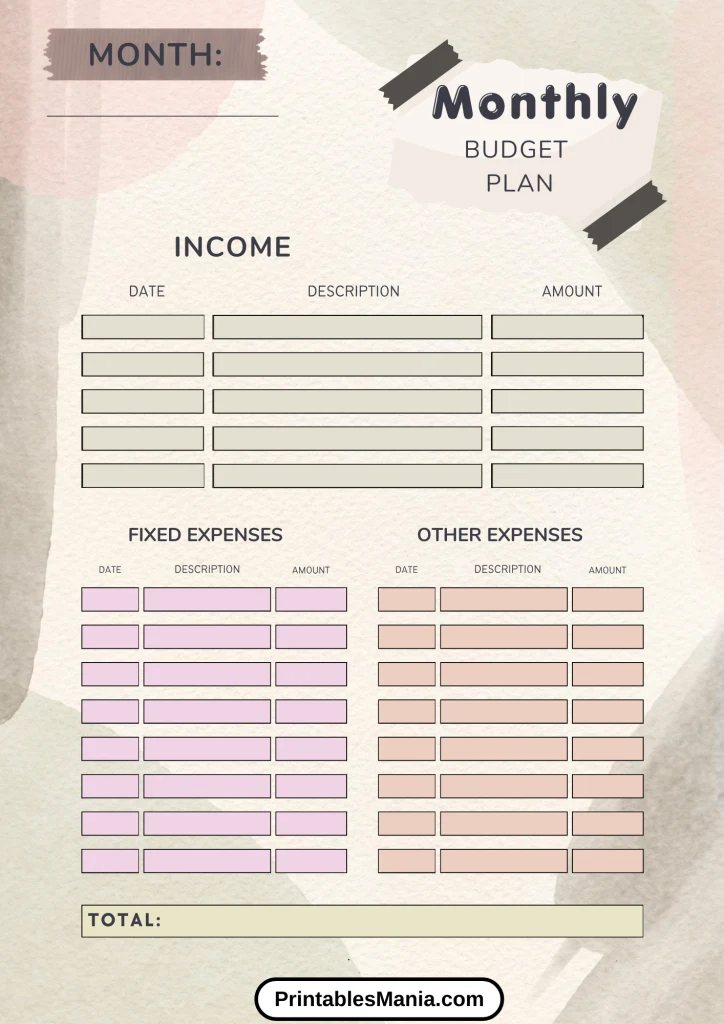

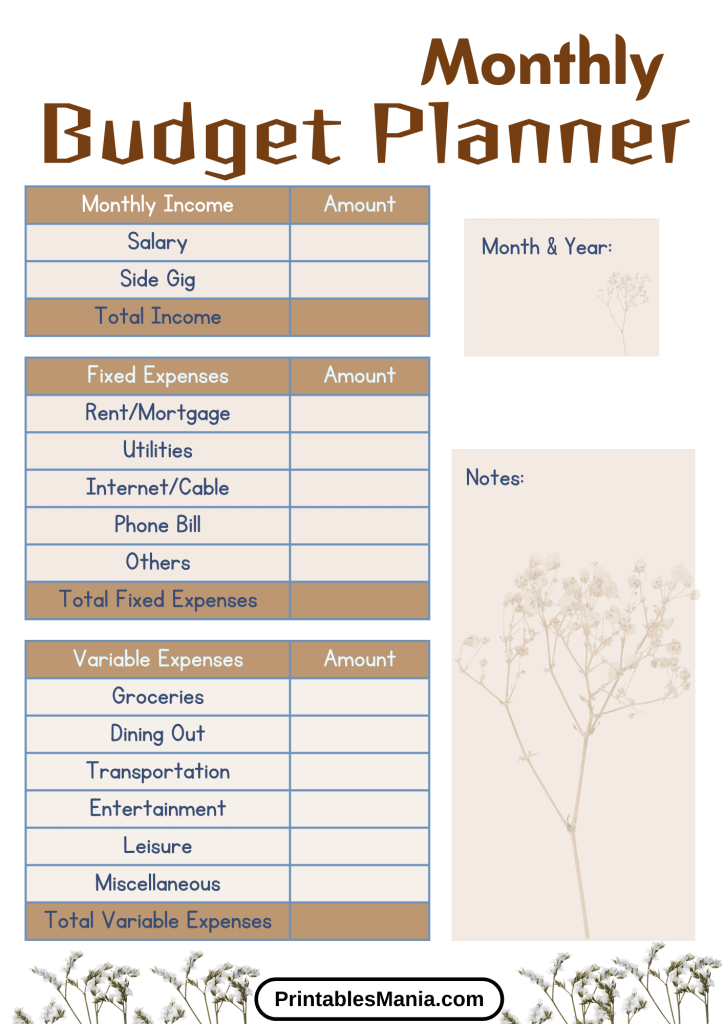

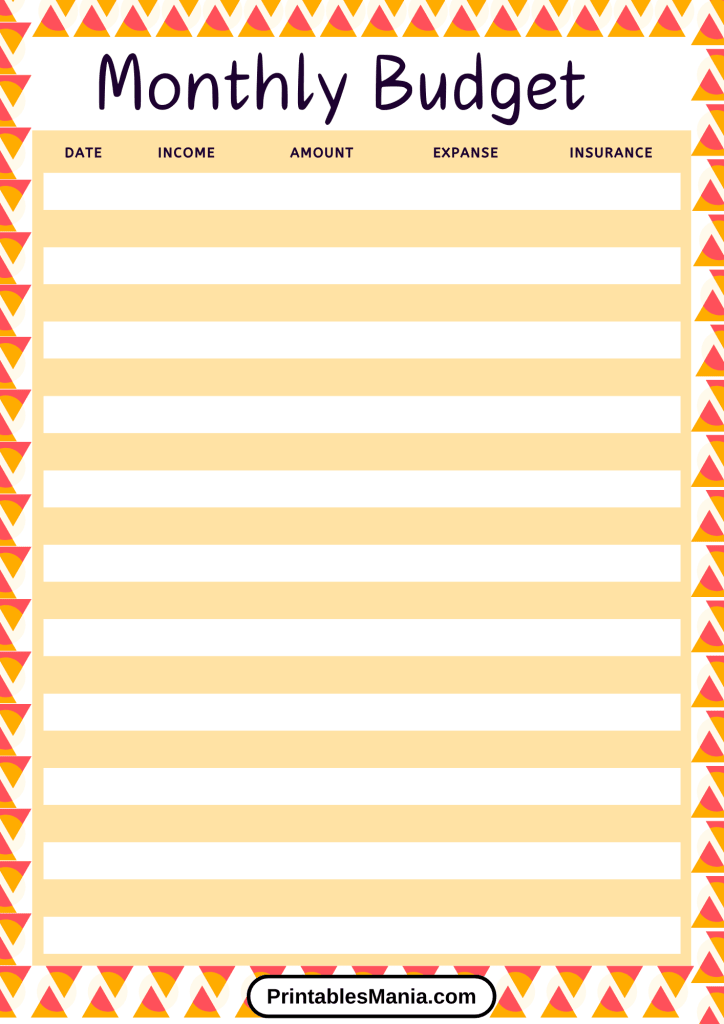

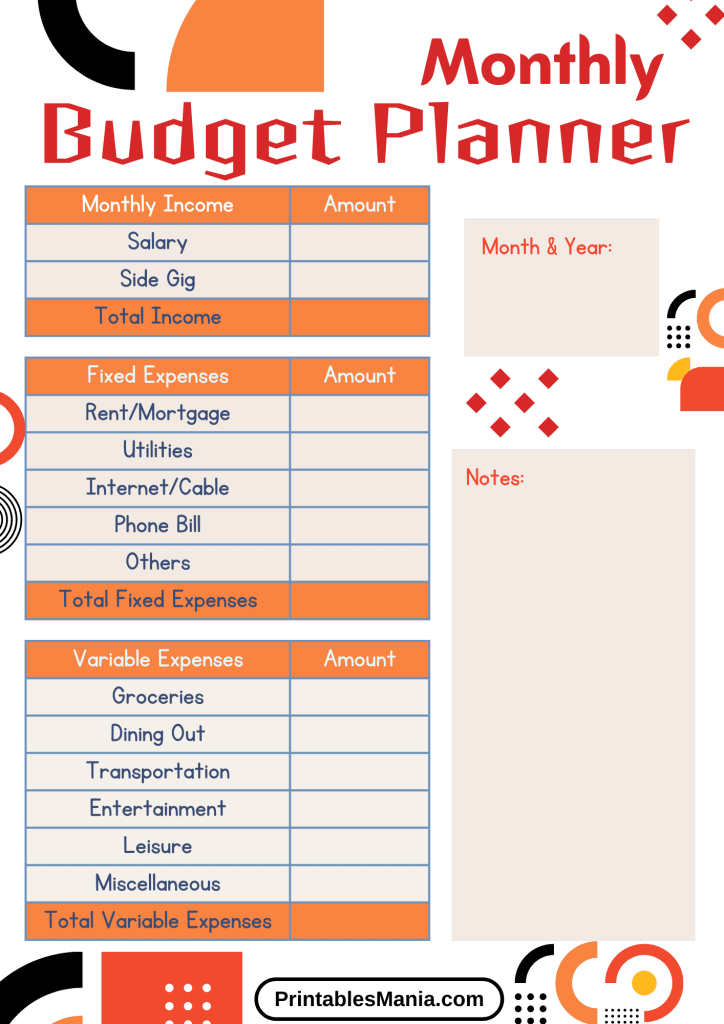

Welcome to our Monthly Budget Planner Printable page! Whether you’re managing household expenses, saving for a vacation, or planning for retirement, our printable budget planners are designed to help you keep track of your finances efficiently. Our templates are simple, user-friendly, and perfect for anyone looking to gain better control over their financial health.

Why Use a Monthly Budget Planner?

Staying on top of your financial situation can be challenging, but a monthly budget planner makes it easier. It helps you:

- Visualize Your Spending: See where your money goes each month.

- Identify Areas for Savings: Pinpoint unnecessary expenses.

- Plan for Future Expenses: Set aside funds for upcoming needs.

- Reach Financial Goals: Stay on track to meet your financial objectives.

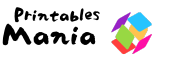

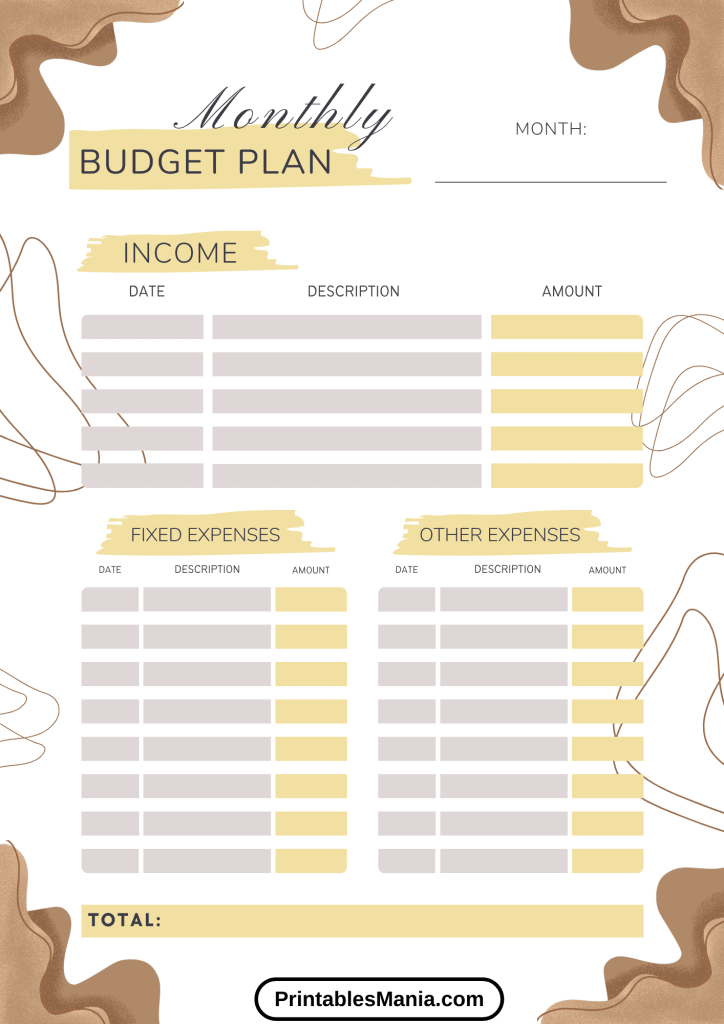

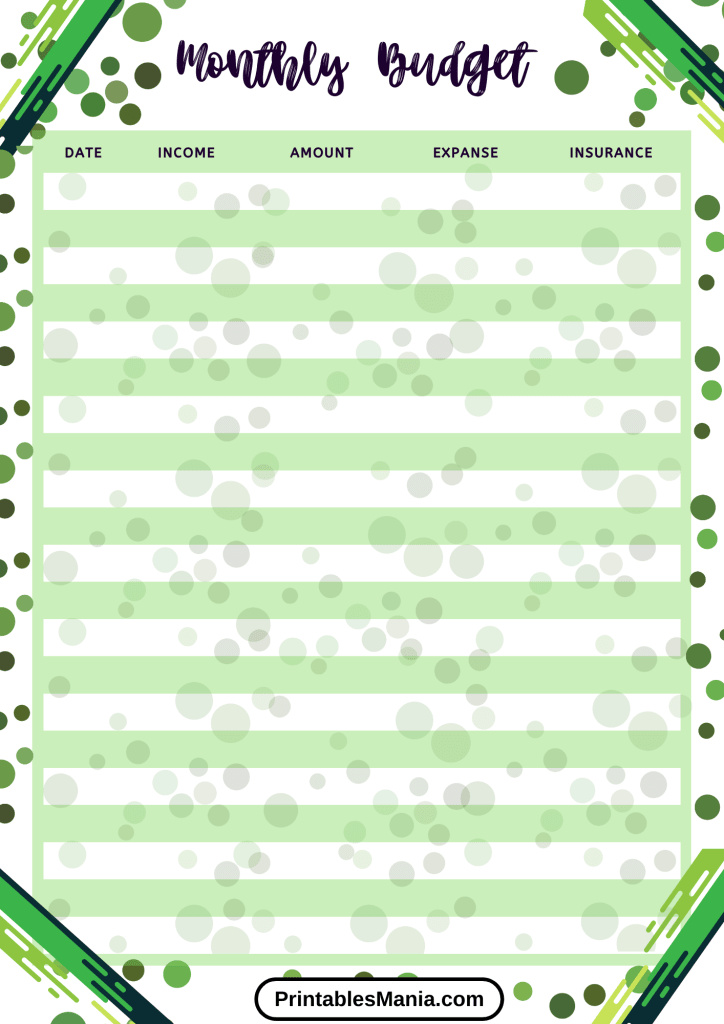

Our printables are designed to be flexible and adaptable to various needs, from the very simple to the highly detailed.

Get Started Today

Download our free Monthly Budget Planner printables and start organizing your finances today. Each template can be printed at home or at any print shop. Just choose the one that best fits your lifestyle and start filling in your income and expenses. It’s that easy to take the first step towards a more organized financial life!

Budgeting Tips for Beginners

Embarking on the journey of budgeting can be transformative, helping you gain control over your finances and achieve your financial goals. Here are some essential budgeting tips tailored specifically for beginners:

Start with a Clear Goal

Having a clear financial goal in mind can provide direction and motivation in your budgeting process. Start by identifying what you want to achieve—whether it’s paying off debt, saving for a down payment on a house, or building an emergency fund. Your goals will guide how you allocate your resources.

Track Your Income and Expenses

Before you can create an effective budget, you need to know exactly where your money is coming from and where it’s going. For one month, track every dollar you earn and spend. This will give you a clear picture of your financial situation and help you identify areas where you can cut back.

Categorize Your Spending

Once you have tracked your expenses, categorize them into fixed and variable expenses. Fixed expenses are those that do not change from month to month, such as rent, mortgage, or car payments. Variable expenses, such as groceries, dining out, and entertainment, can fluctuate and usually offer more flexibility for adjustments.

Create a Realistic Budget

Using the information from tracking your income and expenses, create a budget that reflects your financial reality. Allocate funds to your fixed and essential expenses first, then determine how much you can reasonably spend on variable expenses. Be realistic about what you can afford to spend while still saving money.

Prioritize Savings

One common mistake in budgeting is treating savings as an afterthought. Instead, prioritize savings by treating it as a fixed expense. Decide on a percentage of your income to save each month and deposit it into your savings account as soon as you get paid. This approach, often called “paying yourself first,” ensures that you continuously build your savings.

Adjust as Needed

Your budget is not set in stone. As your income, expenses, and financial goals change, so should your budget. Regularly review and adjust your budget—at least once every few months—to reflect any changes in your financial situation. This flexibility can help you stay committed to your budgeting practice.

Use Tools to Help You Budget

There are many tools and apps available that can simplify the budgeting process. These tools can automatically track your spending, categorize expenses, and even send alerts when you’re nearing your budget limits. Utilizing these can reduce the manual effort required and help you stay on track.

Avoid Common Pitfalls

Be aware of common budgeting pitfalls, such as underestimating expenses or forgetting to budget for irregular expenses like annual subscriptions or car maintenance. Always include a buffer in your budget for unexpected costs to avoid being caught off guard.

Stay Committed and Patient

Budgeting is a skill that improves with practice. It might take a few months to get your budget right and even longer to see the impact of your efforts on your financial goals. Stay committed, adjust your budget as needed, and remain patient. Over time, budgeting will become a natural part of your financial routine, leading to improved financial health.

By following these tips, even beginners can develop effective budgeting habits that pave the way to financial stability and success.

Common Budgeting Mistakes to Avoid

Effective budgeting is a crucial skill for managing your finances, but it’s easy to fall into some common traps, especially when you’re new to the process. Here are some of the most frequent budgeting mistakes to avoid to ensure your financial planning stays on track:

1. Failing to Stick to a Budget

One of the most common mistakes is creating a budget but not following it. A budget is only useful if you adhere to it. Regularly compare your actual spending against your budgeted amounts and adjust your habits accordingly to stay on track.

2. Underestimating Expenses

Many people underestimate how much they spend, which can quickly lead to budget shortfalls. Be sure to track your expenses accurately, and always round up estimates to account for unexpected costs in variable expenses like groceries, utilities, and transportation.

3. Forgetting Irregular or Seasonal Expenses

It’s easy to remember monthly bills, but many forget to account for annual or semi-annual expenses such as property taxes, insurance premiums, or holiday spending. Divide these costs by twelve and include them in your monthly budget to avoid a financial squeeze when these bills are due.

4. Overly Restrictive Budgeting

While it’s important to cut unnecessary expenses, being too restrictive can be unsustainable. If your budget doesn’t allow for any discretionary spending or treats, it might be too harsh, leading to budget fatigue and eventual splurges that blow your budget.

5. Ignoring Savings

Not prioritizing savings is a critical mistake. Always include a savings category in your budget and treat it as a fixed expense. This ensures you consistently build your emergency fund, retirement savings, or other financial goals.

6. Not Adjusting Your Budget

Your financial situation will change over time, and so should your budget. Regular reviews and adjustments are necessary to reflect changes in income, expenses, and financial goals. Failure to update your budget can lead to overspending or missed savings opportunities.

7. Relying on Memory Alone

Trying to manage your budget without writing it down or using a budgeting tool is a recipe for trouble. Use apps, spreadsheets, or good old-fashioned pen and paper to keep detailed records of your budget plan and spending.

8. Mixing Needs with Wants

A common error is confusing wants with needs. Essential expenses (needs) like rent, groceries, and utilities should be prioritized over non-essential spending (wants) like dining out, entertainment, and luxury purchases. Always budget for your needs first.

9. Not Having a Financial Cushion

Always include a buffer in your budget for unexpected expenses. Life is unpredictable, and without a financial cushion, you can quickly go into debt when unplanned costs arise.

10. Giving Up After Setbacks

Setbacks are a normal part of any financial journey. If you overspend or face financial hurdles, don’t get discouraged. Review what went wrong, adjust your budget, and keep moving forward. Persistence is key to mastering your personal finances.

By being aware of and avoiding these common budgeting mistakes, you can maintain a healthier financial plan that accommodates both your current needs and future goals.