Managing debt can be a daunting task, but with our Debt Tracker Printable, you can take control of your finances and pave the way to financial freedom. This easy-to-use tool helps you track your debt, monitor your progress, and stay motivated on your journey to becoming debt-free.

Why Use a Debt Tracker?

A debt tracker is an essential tool for anyone looking to manage and reduce their debt effectively. By keeping a detailed record of your debts, payments, and balances, you can:

- Visualize Your Progress: See your debt reduction in real-time and celebrate your milestones.

- Stay Organized: Keep all your debt information in one place for easy reference.

- Set Goals: Establish clear, achievable goals to keep you motivated.

- Make Informed Decisions: Understand your financial situation better to make smart financial choices.

Features of Our Debt Tracker Printable

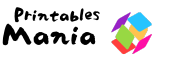

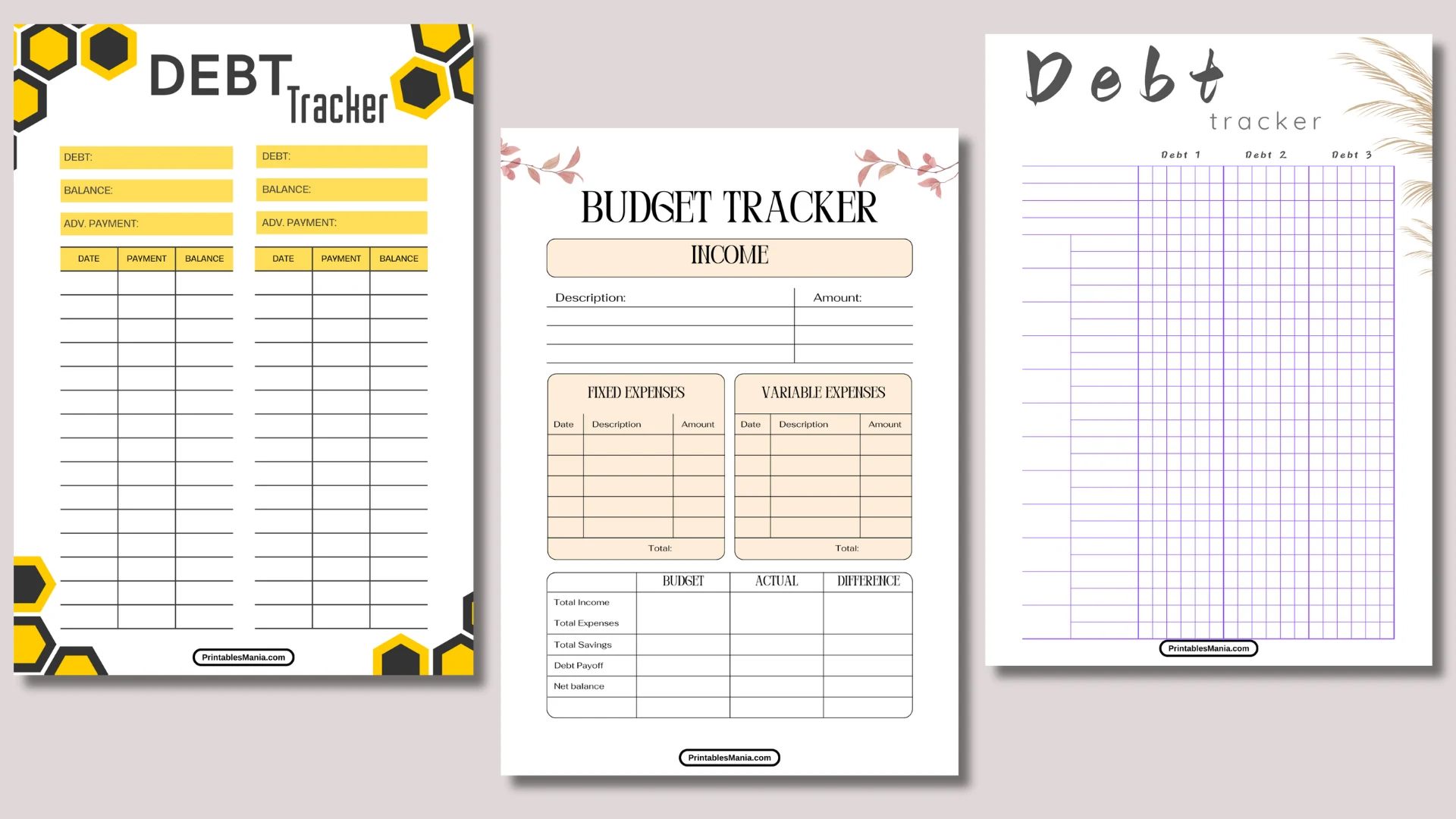

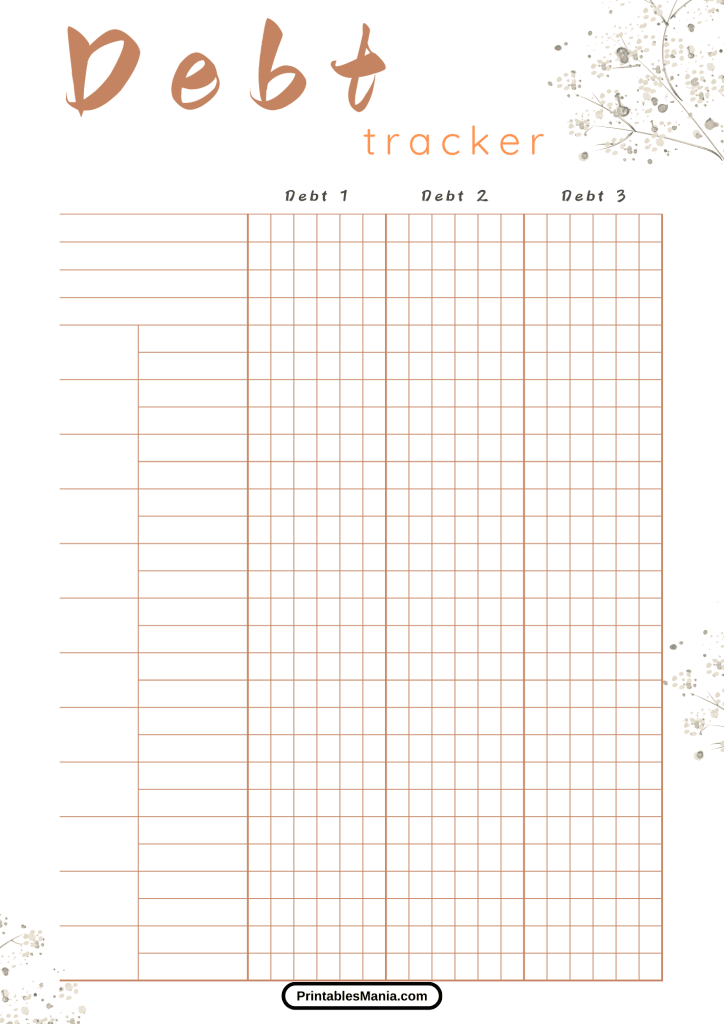

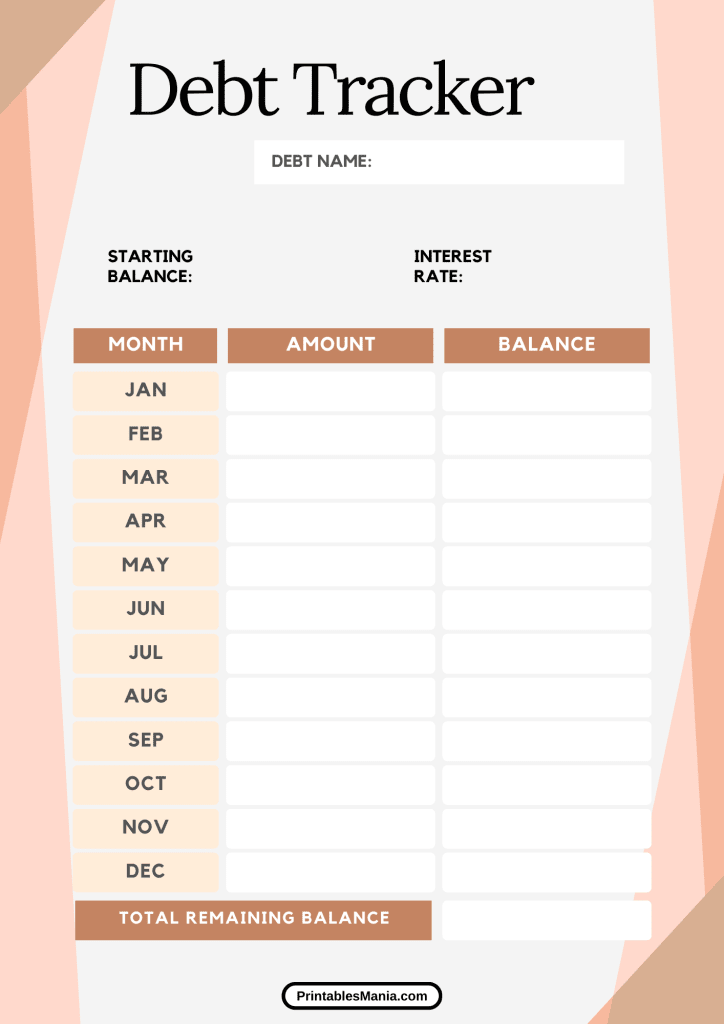

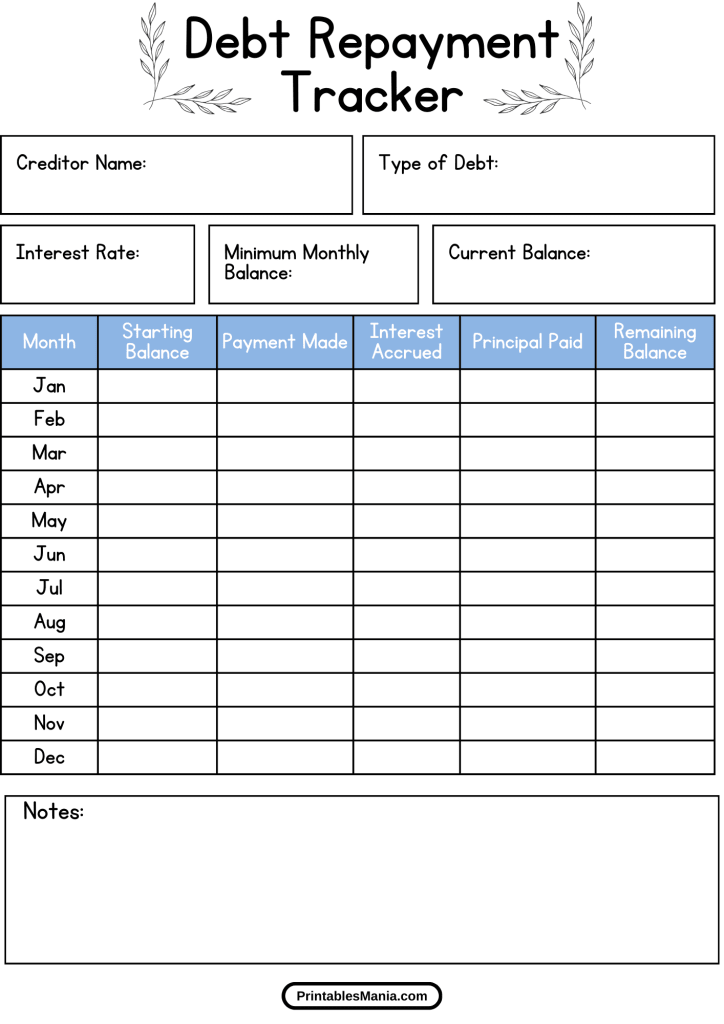

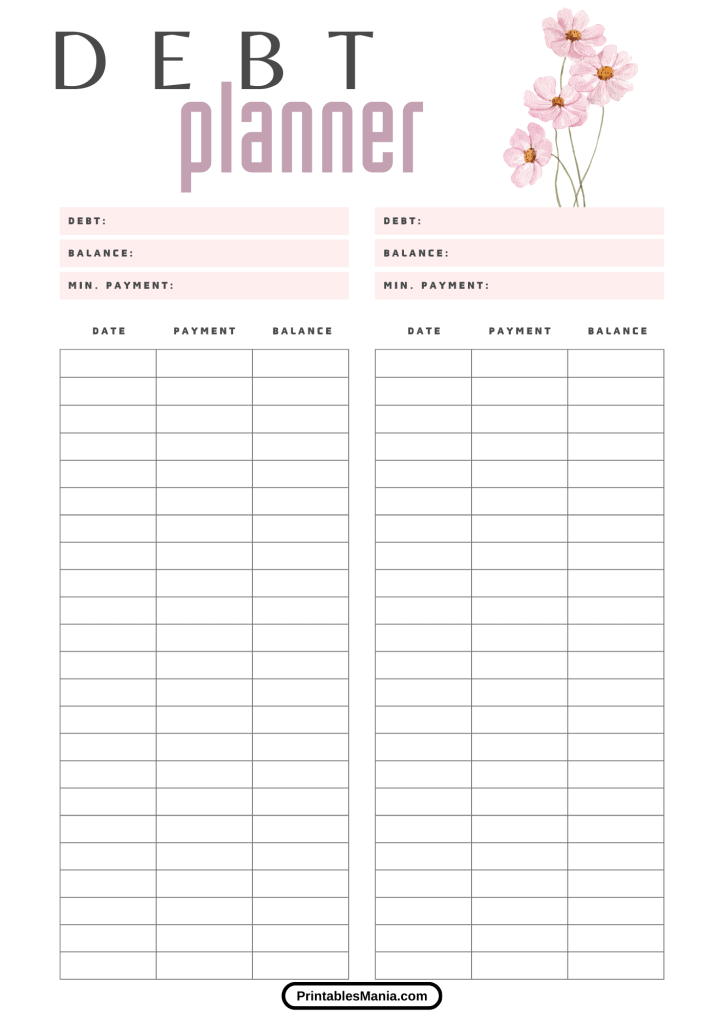

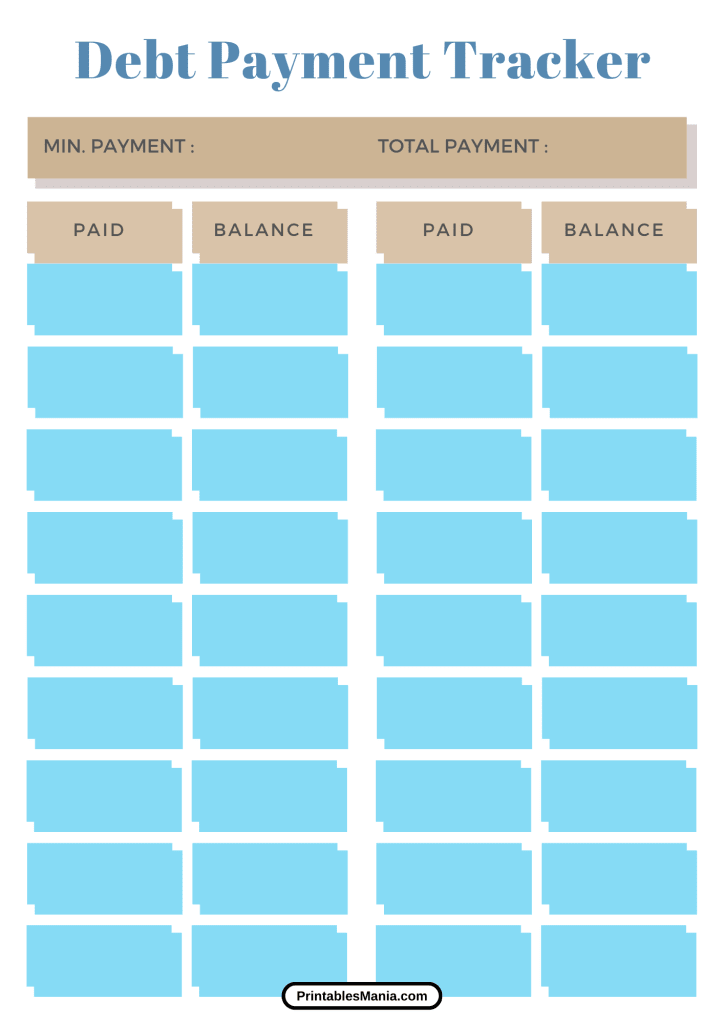

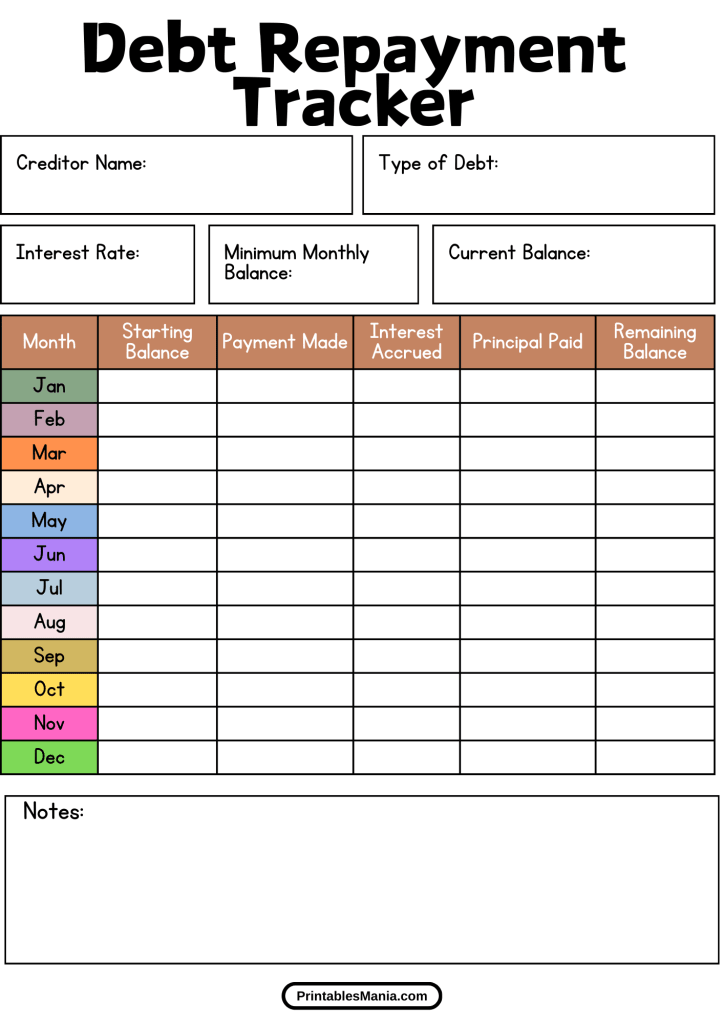

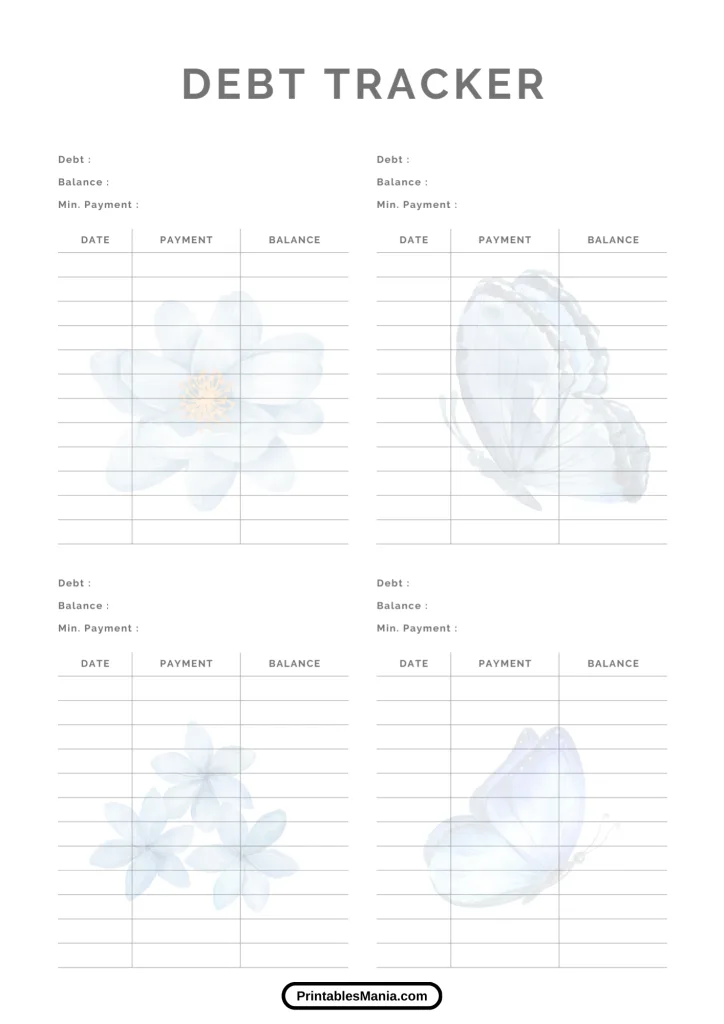

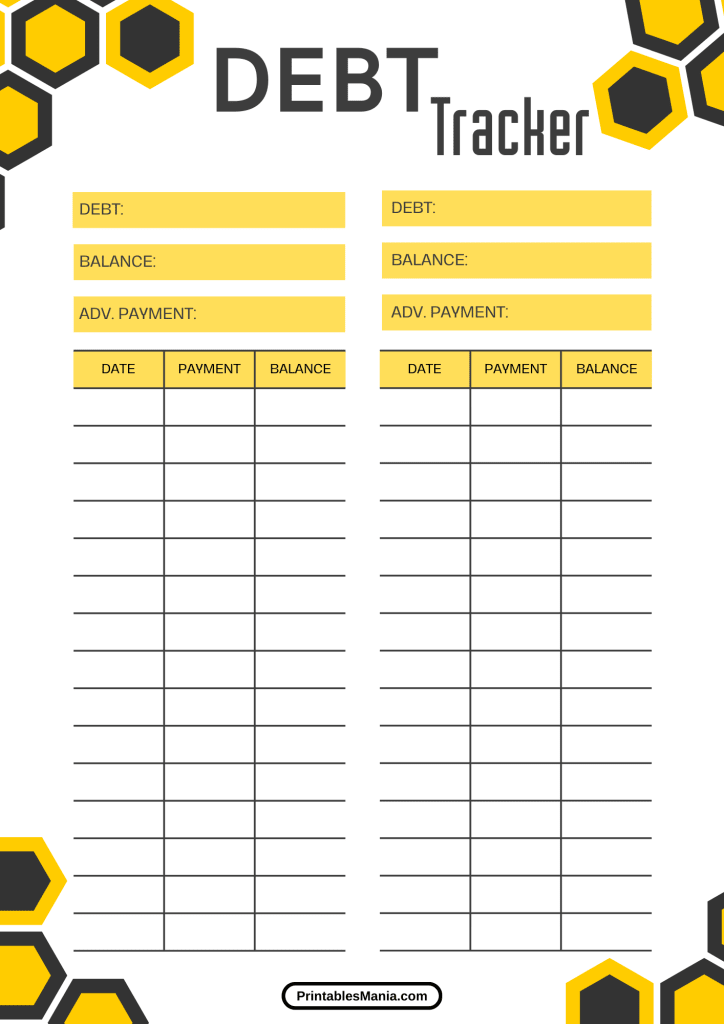

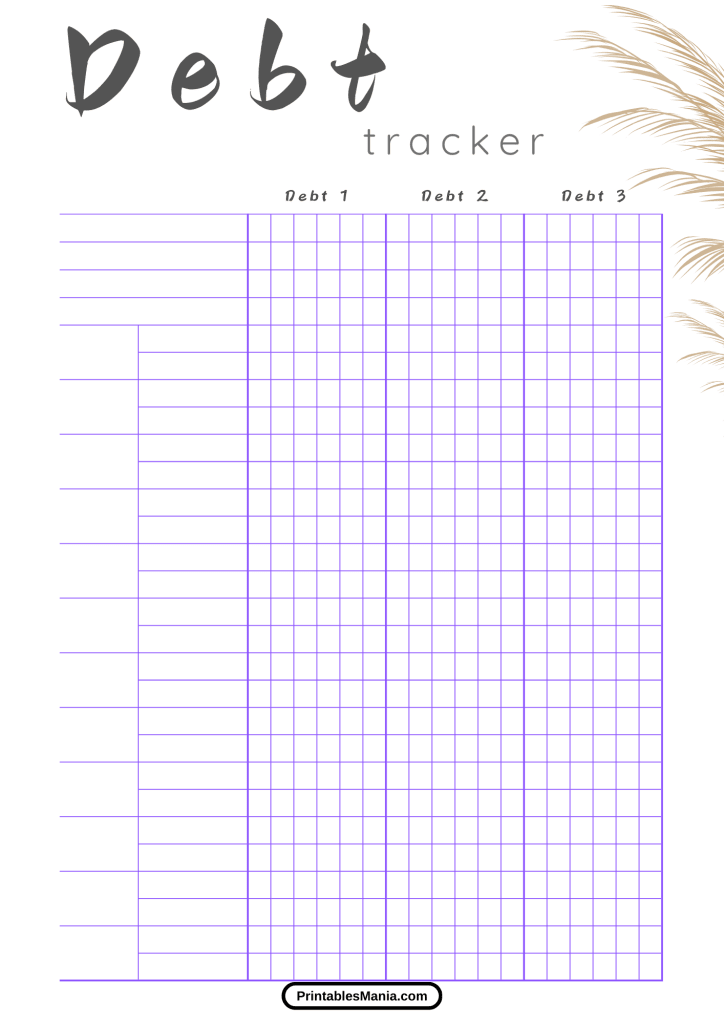

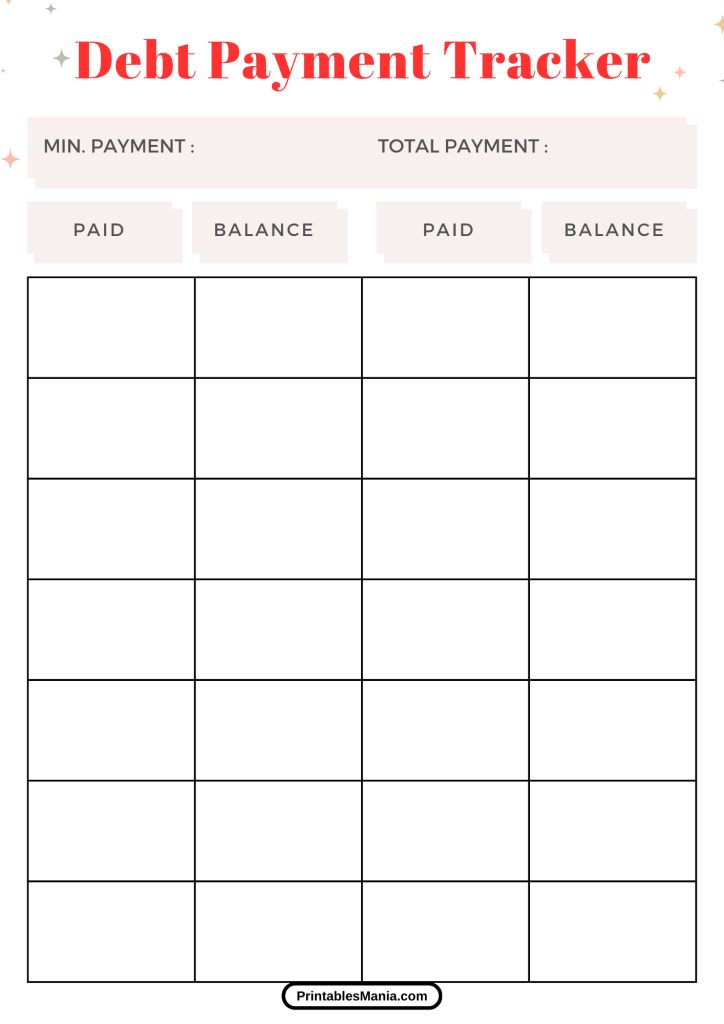

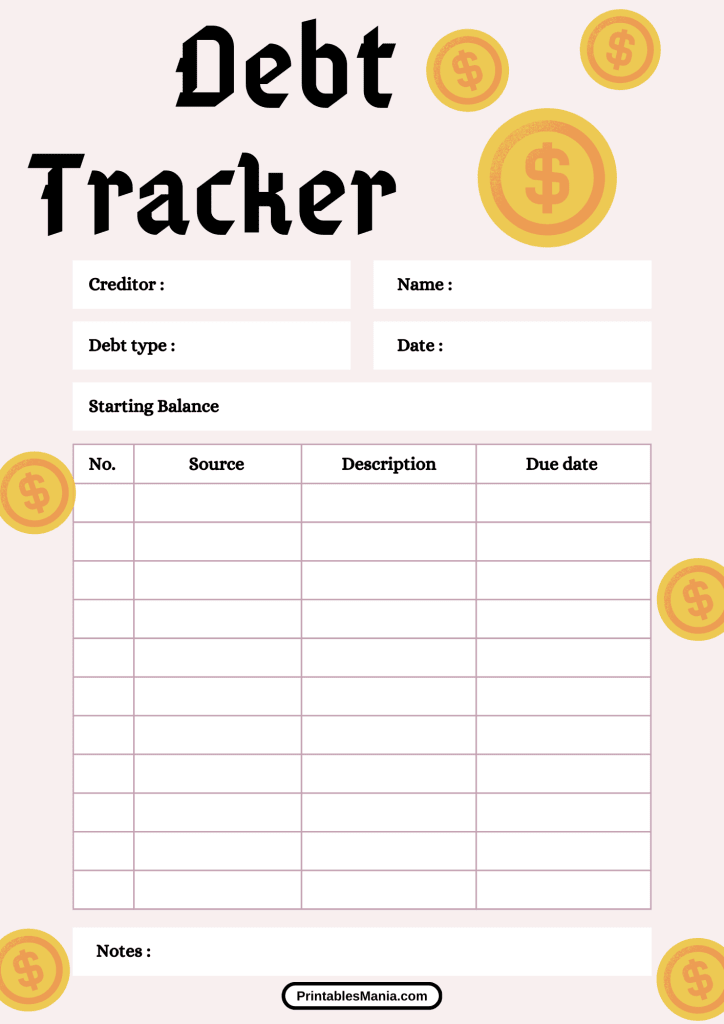

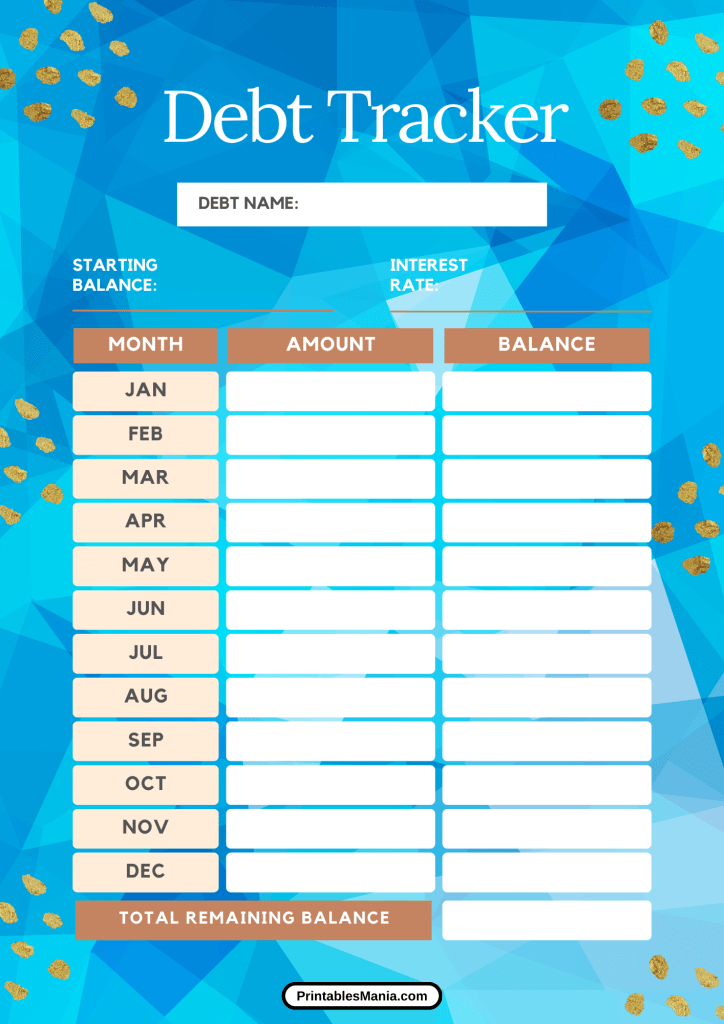

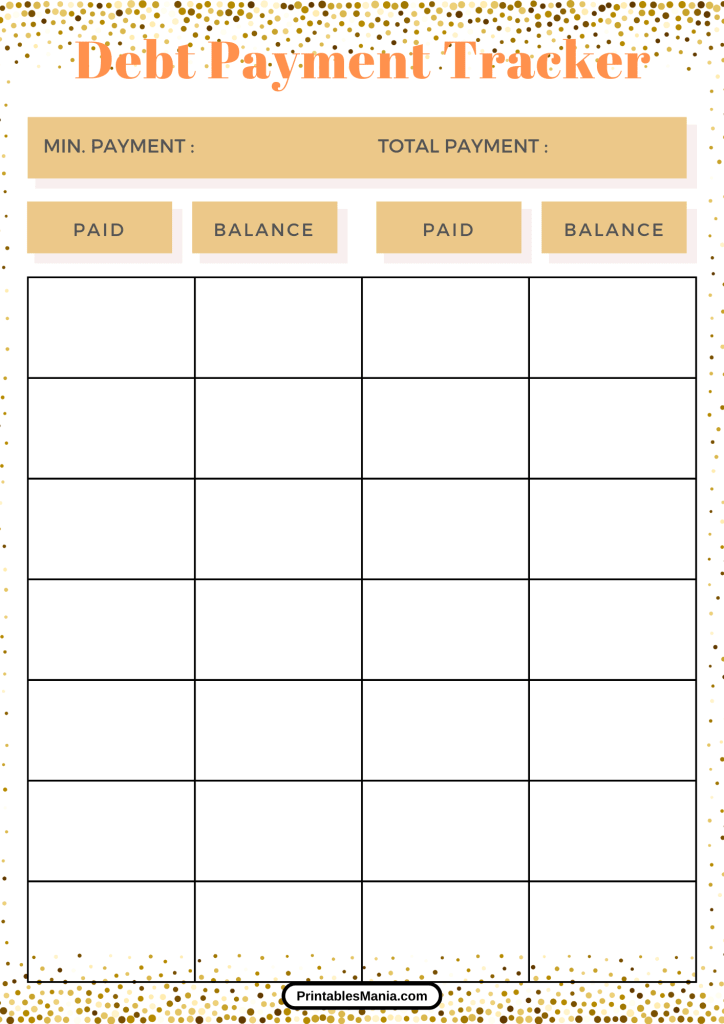

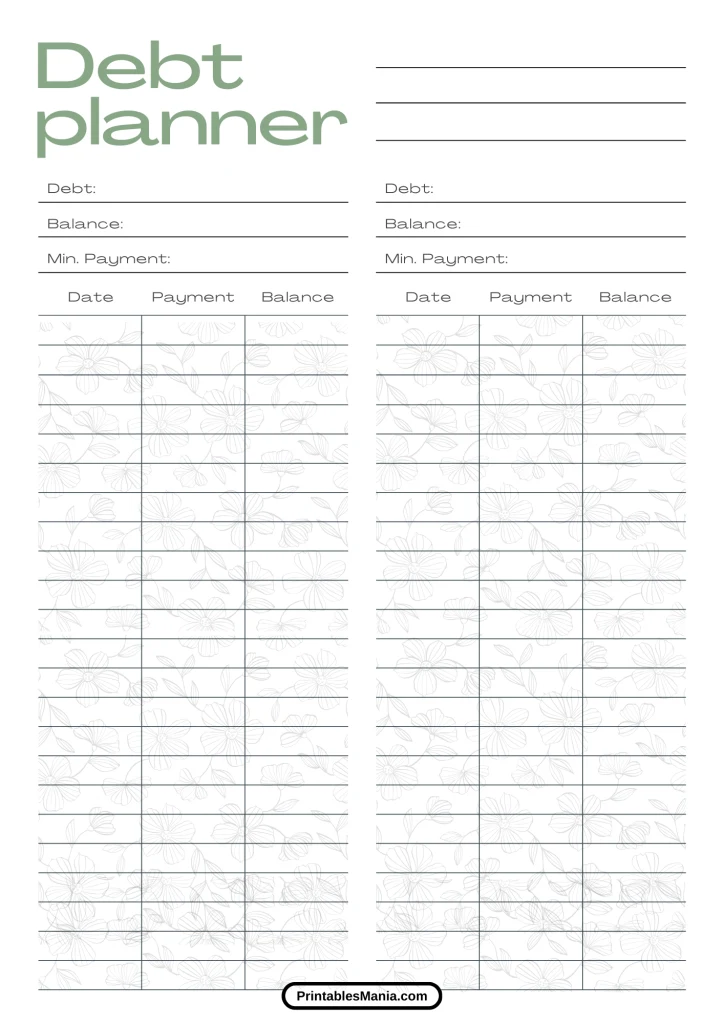

Our debt tracker printable is designed with simplicity and effectiveness in mind. Here are some of the features you’ll find:

- Easy-to-Use Layout: Intuitive design for hassle-free tracking.

- Comprehensive Fields: Record all necessary details such as creditor names, balances, interest rates, and payment dates.

- Progress Tracking: Visual aids to help you monitor your debt reduction over time.

- Goal Setting Section: Dedicated space for setting and tracking your debt repayment goals.

How to Get Started

Getting started with our debt tracker is simple. Follow these steps:

- Download the Printable: Access and print the debt tracker from our website.

- Fill in Your Details: Enter all relevant information about your debts.

- Track Your Payments: Regularly update the tracker with your payments to see your progress.

- Review and Adjust: Periodically review your tracker and adjust your repayment plan as needed.

Take Control of Your Finances Today

Don’t let debt overwhelm you. With our Debt Tracker Printable, you have a powerful tool to help you manage and reduce your debt effectively. Download it today and take the first step towards financial freedom!

Benefits of Using a Debt Tracker

Improved Financial Awareness

A debt tracker provides a clear and organized view of your financial obligations. By regularly updating your tracker, you’ll always know the exact amount you owe and to whom. This heightened awareness helps you make informed decisions about your finances and prioritize your debt repayment strategies effectively.

Stress Reduction

Debt can be a significant source of stress and anxiety. A debt tracker simplifies the process of managing multiple debts by keeping all information in one place. Knowing you have a clear plan and seeing your progress can significantly reduce financial stress and give you peace of mind.

Goal Setting and Achievement

A debt tracker allows you to set realistic and achievable financial goals. By breaking down your debt repayment into smaller, manageable steps, you can track your progress and celebrate milestones along the way. This not only keeps you motivated but also provides a sense of accomplishment as you get closer to being debt-free.

Enhanced Accountability

Using a debt tracker holds you accountable for your financial actions. By regularly updating your tracker, you can clearly see the impact of your spending and repayment habits. This accountability can help you stick to your budget and avoid unnecessary expenses that could delay your debt repayment progress.

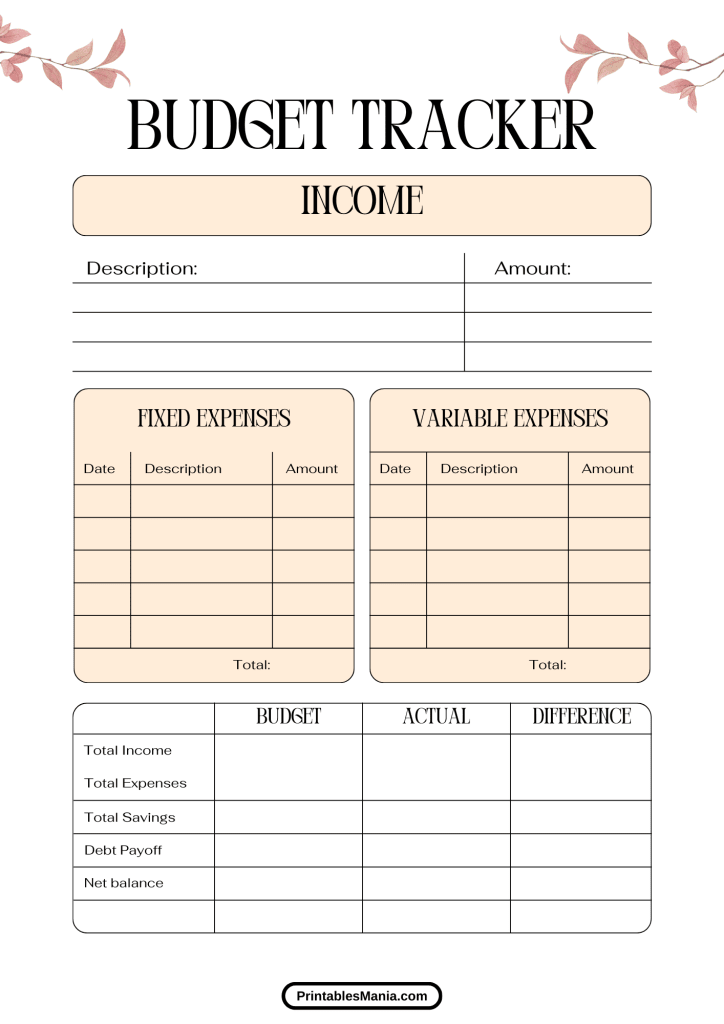

Financial Planning

A debt tracker is an invaluable tool for overall financial planning. It helps you see the bigger picture of your financial health, allowing you to plan for future expenses, savings, and investments. With a clear understanding of your debt situation, you can create a more effective and realistic financial plan.

Success Stories

Real-Life Examples of Debt Reduction

Sarah’s Journey to Financial Freedom

Sarah was overwhelmed with multiple credit card debts and student loans. She decided to use our debt tracker to get organized. By prioritizing her high-interest debts and tracking her monthly payments, Sarah was able to see her progress clearly. Within two years, she paid off all her credit card debts and significantly reduced her student loans. Sarah’s journey shows how a debt tracker can provide the structure and motivation needed to tackle debt effectively.

John’s Success with Debt Consolidation

John had several small loans with varying interest rates, making it hard for him to keep up with payments. He used our debt tracker to consolidate his debts and create a single monthly payment plan. By tracking his progress and making consistent payments, John managed to pay off his consolidated loan in just three years. His story highlights the importance of organization and consistency in managing and paying off debt.

Emily’s Method for Tackling Medical Bills

Emily faced significant medical bills after an unexpected health issue. Feeling overwhelmed, she turned to our debt tracker to manage her payments. By using the tracker to record each bill, set up payment plans, and monitor her progress, Emily successfully paid off her medical debts within a year. Her experience demonstrates how a debt tracker can help manage even the most daunting financial challenges.

Testimonials from Satisfied Users

Alex’s Testimonial

“Using the debt tracker was a game-changer for me. It was the first time I felt in control of my finances. Seeing my progress each month kept me motivated, and I’m now debt-free! I highly recommend it to anyone struggling with debt.” – Alex

Maria’s Feedback

“The debt tracker made managing my loans so much easier. I loved being able to see exactly how much I owed and setting clear goals for repayment. It made a huge difference in how I approached my debt.” – Maria

David’s Experience

“I was skeptical at first, but the debt tracker really helped me stay on top of my payments. It was straightforward to use and very effective. Thanks to it, I’ve paid off my car loan ahead of schedule!” – David

By sharing these benefits and success stories, you can inspire and encourage others to take control of their debt and work towards financial freedom with confidence.